For many years AFSL (Australian Financial Services Licence) holders have been familiar with the process of lodging the form FS70 (Australian financial services licensee profit and loss statement and balance sheet) each year after the completion of their annual audit.

While there have been some minor changes over the years, such as the removal of postal & in person lodgements, transition from SPFR to GPFR and minor formatting updates, the process has been quite consistent. However, in 2025 ASIC has completely overhauled the process and confused many AFSL holders and professional advisers while doing so.

In Summary

From 2025 Onwards:

The forms (FS70 & FS71) have been renamed

Form numbers removed

Lodgement is moved to the AFS Licensing Dashboard within the ASIC Regulatory Portal

The questions asked are significantly more extensive.

The new forms include pre-filled data to make it easier to fill some details.

There is no longer a pdf version of what was called the FS70.

Contents:

Instructions for AusAudit clients

Details of FS70 / FS71 form changes

Accessing the new portal

New submitting AFSL financials form

Shared Access

For AusAudit Clients

If you are not yet a client of Australian Audit, we would love to hear from you to see how we can assist with your audit requirements.

Once your audit has been completed, we will provide you with a fully signed copy of your annual general purpose financial statements (including your signed director’s declaration and our signed audit opinion) and the signed Auditor’s report for Australian financial services licensee (previously FS71).

You can then proceed to draft your Submit Australian financial services licence annual financial statements in the AFS Licensing Dashboard. The below guide should assist you to complete this more easily.

At the ‘review’ screen, print to pdf, ‘save and close’, and send us a copy for review before you proceed to lodgement.

After lodgement, send us a copy of the record of transaction to put on our files

Once submitted there is no opportunity to make further changes to the form, hence especially in the first year we encourage you to send to us for a double check prior to submitting to ASIC.

Forms

AFSL Holder Financial statements

Previous name: FS70- Australian financial services licensee profit and loss statement and balance sheet

New name: Submit Australian financial services licence annual financial statements

Lodgement options: Now only available from the AFS Licensing Dashboard within the ASIC Regulatory Portal (https://regulatoryportal.asic.gov.au/).

Form length: Was 6 page pdf form plus 2 page guide. Now the completed form printed to pdf is 32 pages long.

AFSL Auditor form

Previous name: FS71- Auditor’s Report for AFS Licensee

New name: Auditor’s report for Australian financial services licensee

Lodgement options: Upload pdf to ASIC as part of FS70/AFSL annual financial statements

Form length: Was 15 page pdf form plus 3 page guide. New form is the same length.

The new form includes the ASIC logo at the top of the first page, using an out of date form will make it very difficult for the AFSL holder to lodge their financial statements, as they are asked questions about the content of the auditor’s report.

Accessing the new Portal

For an AFSL holder to submit their annual financial statements, they first need to access the correct form within the new portal as follows:

Login to the ASIC Regulatory Portal (https://regulatoryportal.asic.gov.au/).

Some common login issues are resolved by using a different browser

ASIC has many different portals, be sure to use the regulatory portal for AFSL lodgements

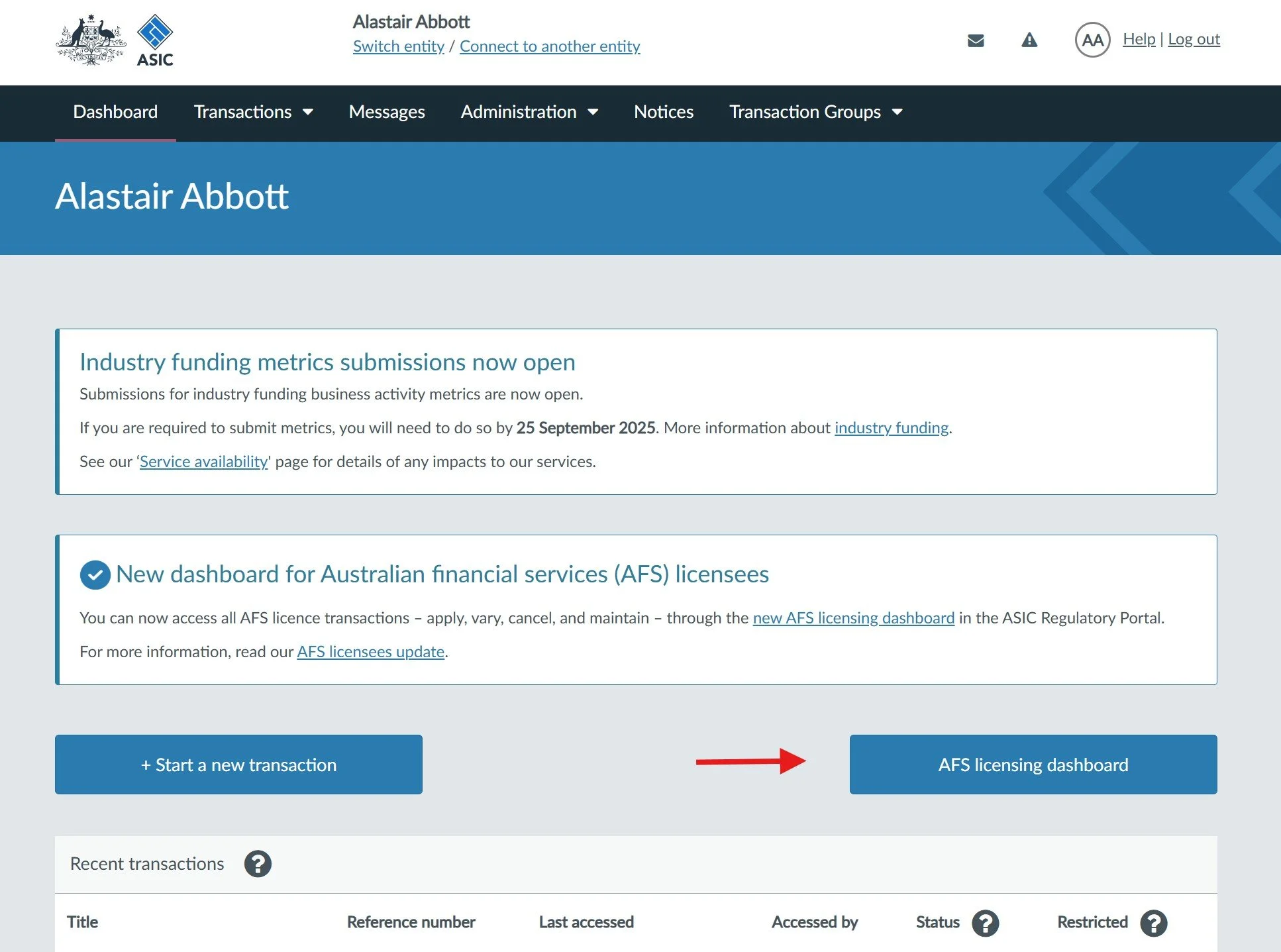

Select the appropriate entity, and then click on ‘AFS licensing dashboard’ button

On the next screen select ‘view transactions’ if you wish to see past or draft lodgements or ‘start a new transaction’ for a new lodgement.

Submitting AFSL financials form

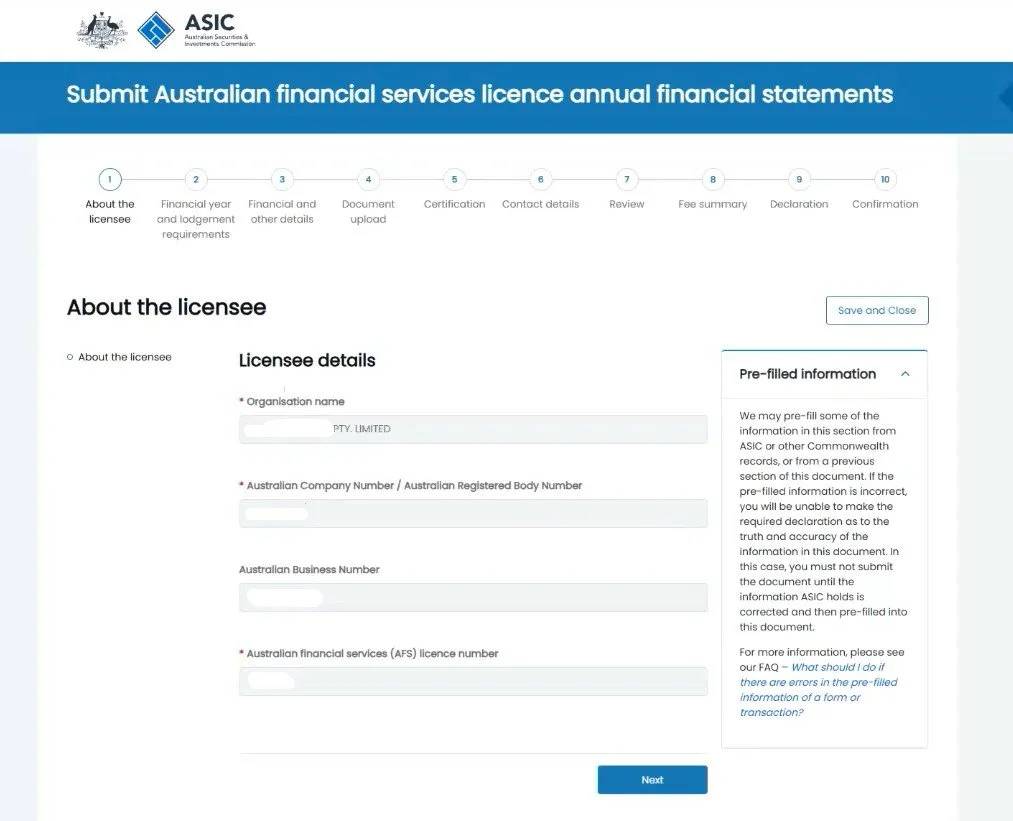

Select the form called ‘Submit Australian financial services licence annual financial statements’ .

Work through the form from start to end

You can save your progress and return at a later time to complete further

Some of the fields will be pre-filled based on ASIC or other commonwealth records

Further down in this guide we have included a summary of all the questions asked

STOP: print the review screen and email to your auditor

Once you submit the form there is no option to make further changes. When you get to the review screen:

Print to pdf and email to your auditor

click ‘save and close’

Once we have double checked your responses, you can return to complete your submission to ASIC

When you get to the review screen, you can print your responses for your records and checking prior to lodgement

You will only see questions you have answered / that were presented to you in your form

Click ‘next’ for your fee summary. If any fees are payable you will have the option to pay or request an invoice

This is followed by a declaration to sign confirming responses in the form and then a confirmation of lodgement

After lodgement you can select ‘View transactions’, select the relevant transactions and click on ‘view record of transaction’ in order to download a formal pdf of your lodged transaction

The download option will initially be greyed out, and may take a few minutes or hours before it is available to download.

The download will not include copies of the pdf documents that you uploaded as part of the transaction

Questions in the AFSL Financials Form

The new form is designed to only show questions relevant based on your responses. Because of this not every question will be visible every time you complete the form. However, every question and every guidance box is visible in the formal pdf record of the transaction that can be downloaded after lodgement.

We have tried to highlight some of the main questions below to give you an idea of what is included in the form. You will note that this is significantly more extensive than the details that were included in the previous form FS70.

About the licensee: Prefilled information of the licensee's name and numbers.

Financial year and lodgement requirements:

What financial year the report is for - you will only be able to select years that haven’t yet been lodged to ASIC

Whether the entity is a disclosing entity - generally disclosing entities are either ASX listed or companies with over 100 shareholders

Whether the entity held a limited AFSL - the question is confusing in the way it is worded. Limited AFSL are mostly accounting firms that can only give advice around superannuation. Most AFSL are not a limited AFSL and will answer no to this question.

Was the licensee only licensed to provide one or more limited financial services as defined in reg 7.8.12A(4) of the Corporations Regulations 2001 for any part of the financial year to which this transaction relates?

Did the AFSL deal with client money

Financial and other details:

Summary financial information from financial statements

Description of principal business - select from the drop down - frequently selected options include:

Provider of personal advice on relevant financial products to retail clients

Provider of personal or general advice to wholesale clients only

Provider of general advice to retail or wholesale clients

Managed discretionary account provider

Retail over-the-counter derivatives issuer

Securities dealer

Insurance product distributor

Claims handling and settling services provider

Responsible entity

Custodian

Details of dividends, options, indemnification and proceedings

For responsible entity / IDPS / CCIVs: NTA, cash, liquid assets, revenue, etc

For custodial or depository services: NTA, cash, liquid assets, revenue, etc

For OTC derivative issuers: liabilities, NTA, cash, revenue, etc

Professional indemnity insurance requirements

Was PI insurance required?

Sum insured, excess, PI insurance claims

Compliance certificate: A self-declaration for the licensee to make about various required aspects of their licence. This is only applicable for AFSL holding a limited licence.

Auditor’s report: For AFSL holders with a full licence that required an annual audit. This section asks details about the auditor and the auditor’s report.

The auditor details are included in the Auditor’s report for AFSL form

Australian Audit is NOT an auditor-general

The subsequent questions go through all sections of the Auditor’s report for AFSL form, asking the AFSL holder to duplicate almost all the auditor’s responses into the AFSL holder’s form.

Document upload:

Note: The new ASIC portal appears to give erroneous ‘active content’ warnings less often than the previous portal.

Documents to be uploaded include:

Financial statements - the formal, signed general purpose financial statements of the entity, including the signed director’s declaration and signed auditor’s opinion

The ‘Auditor’s report for Australian financial services licensee’ - previously known as FS71

If ASIC Corporations (Managed Discretionary Account Services) Instrument 2016/968 requires the licensee to lodge an audit report, attach that report

If ASIC Corporations (Investor Directed Portfolio Services) Instrument 2023/669 requires the licensee to lodge an audit report, attach that report

If for any other reason an audit report is required, attach that report (you can upload up to 10 files)

Certification: certification of compliance with mandatory items

Financial statements are general purpose and not special purpose

Ongoing compliance with ASIC financial requirements

Uploaded auditor’s report is a true copy

Contact details: For ASIC to contact about the form

Fee summary: Fees are only charged if the form is lodged late

Declaration: That the form is correct and ready for lodgement

Shared Access

The new ASIC regulatory portal makes it very easy to give access to other parties such as your accountant, compliance consultant or administrative assistant. Select Administration > Users, and follow the prompts to invite a new user to your entity.

For each transaction you start in the portal you can select whether or not to share access to other users.

Note: Due to audit independence requirements, Australian Audit will not accept an invitation to your regulatory portal, and is unable to lodge the Submit Australian financial services licence annual financial statements (FS70) transaction on your behalf.